la county tax collector duplicate bill

La County Tax Collector Duplicate Bill bill county duplicate Edit Po box 99 durango co 81302 phone. You may also obtain a copy of this notice by calling the La Plata County Treasurers Office at 970-382-6352.

Unsecured Property Tax Los Angeles County Property Tax Portal

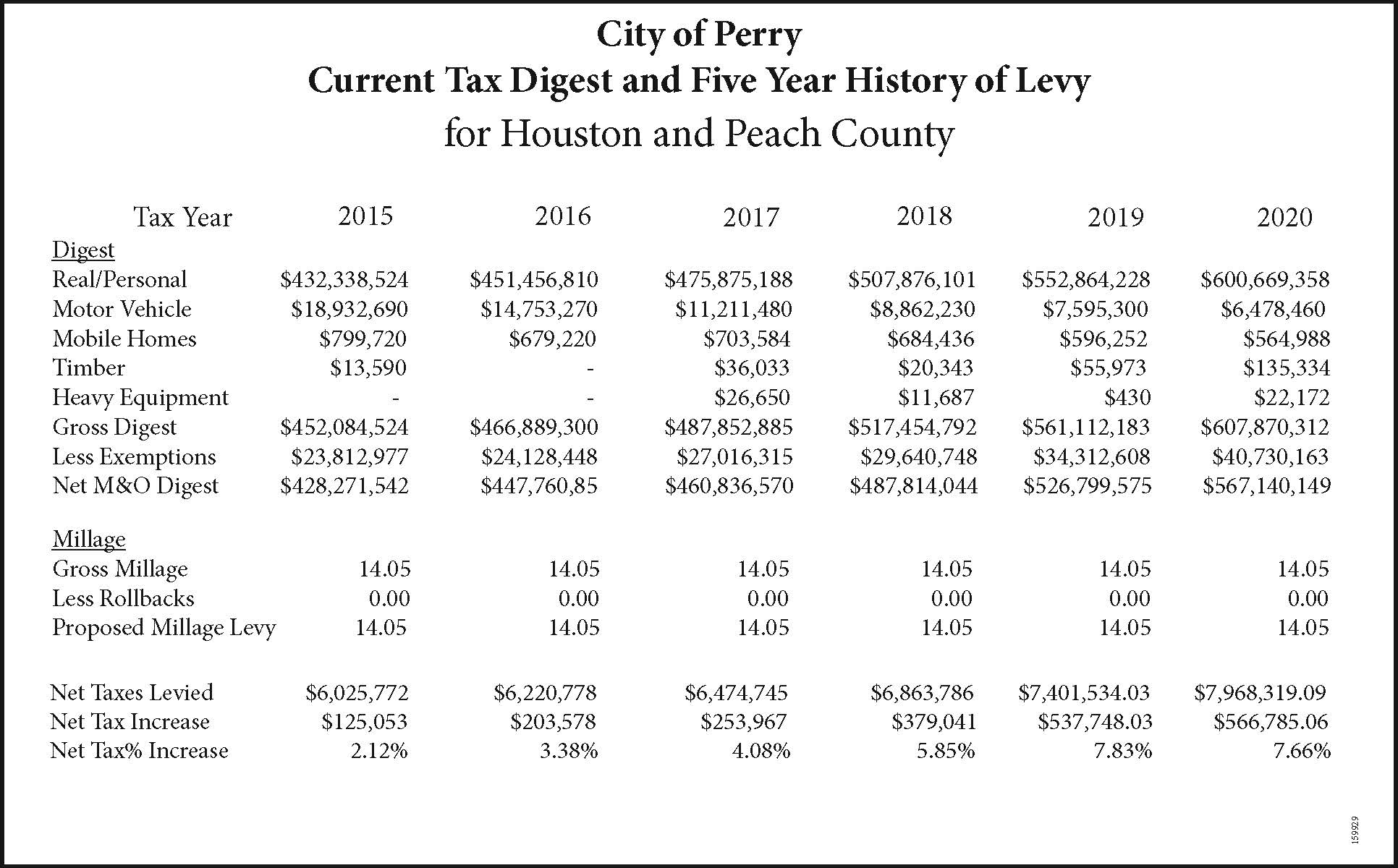

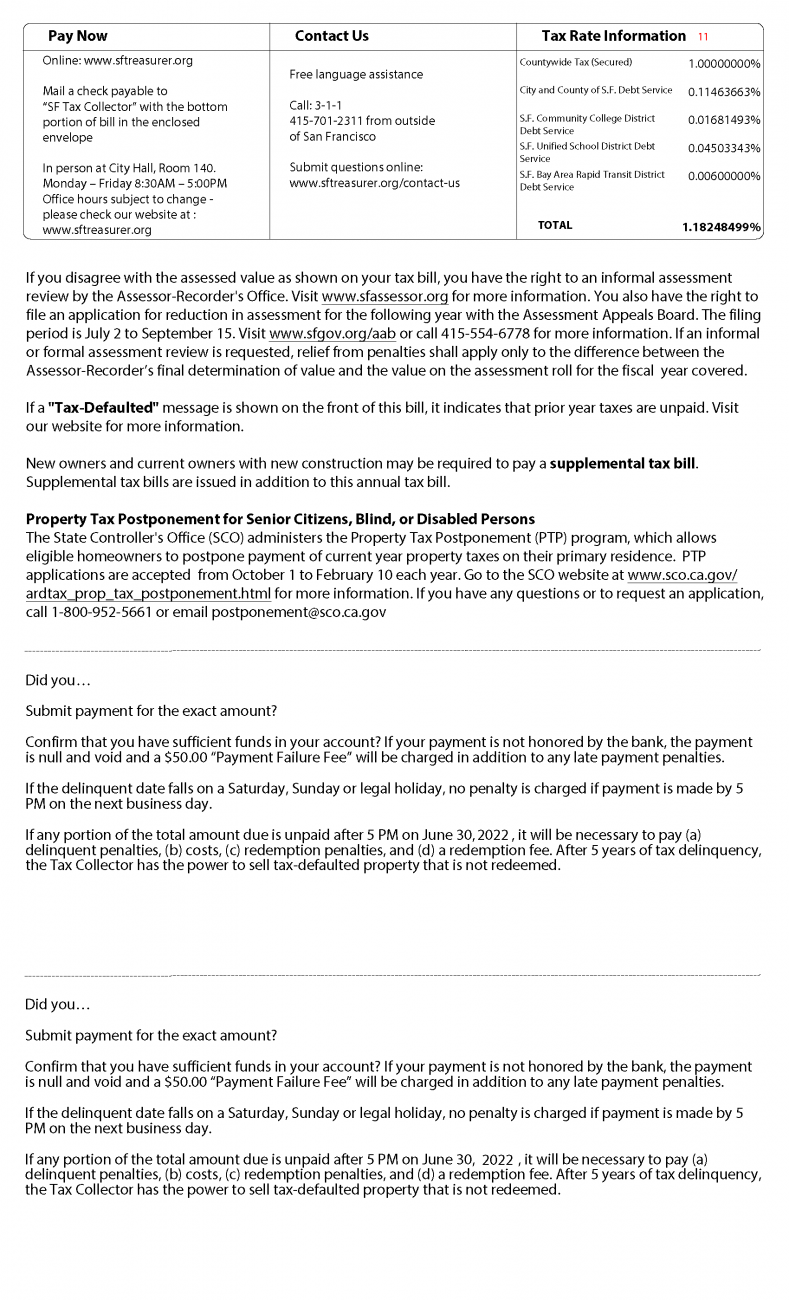

Even though known taxes are prorated between the buyer and seller during escrow and proper credit is given to each all annual property taxes may not have been paid to the Tax Collector at that time.

. Please note that there is a convience fee of 2 12 Percent charged by the processing company for credit card payments and a 200 processing fee for an electronic check. Need the Personal Identification Number PIN which is printed on any original tax bill. Excluding Los Angeles County holidays.

225 North Hill Street Room 115 Los Angeles California90012. 888 807-2111 Toll Free 213 974-8368. If you do not receive your tax bill by November 1 you may request a Duplicate Bill or call the Treasurer and Tax Collector at 213-974-2111.

From secured tax bill Map BookPageParcel Company NoAssessment No. Note the original bill may still have the prior owners name on it the first year. Los Angeles CA 90012.

You may contact the Los Angeles County Treasurer-Tax Collectors Office for questions about. Los Angeles County Auditor-Controller. The state of Louisiana is ranked 32nd in Treasurer Tax Collector Offices per capita and 30th in Treasurer Tax.

Property Tax Services Division. LOS ANGELES COUNTY ASSESSOR 500 W. Or call the Lake County Treasurers Office at 847-377-2323.

It is also the responsibility of the tax collector to provide notice to every taxpayer his agent or representative the amount of property tax due no later than the 4th monday in november. We apologize for any inconvenience. Do not mail your payments to any other address.

For a duplicate bill email us at infottclacountygov. From unsecured tax bill whichever applies Document Number from deed Recording NoRecording Date if known. 1099 Tax Form for Vendors.

Auction Book for Delinquent Properties. If you have any questions about the duplicate payment refund procedure or your situation regarding a duplicate payment please do not hesitate to call this office at 630-407-5900 during our normal business hours 800 AM - 430 PM Monday - Friday. Property Tax Payment History.

BOX 54027 LOS ANGELES CA 90054-0027. The annual bill has two payment stubs. Please use the envelope enclosed with your Unsecured Property Tax Bill and include the payment stub from your tax bill.

Property tax notices will be mailed to the address on record in the ASSESSORs system by the end of January 2021. If you did not receive your Annual Secured Property Tax Bill by November 1 you may request a copy by calling the Treasurer and Tax Collectors automated Substitute Secured Property Tax Bill Request Line at 213 893-1103. We will mail you a bill within three business days.

Contact Us Lee County Tax Collector You may purchase duplicate tax bills for 1 at any Tax Collectors office. If you do not receive the original bill by November 1 contact the County Tax Collector or Assessor for a duplicate bill. Los Angeles County Tax Collector.

500 West Temple Street Room 153. Do not attach staples clips tape or correspondence. The first installment payment is due November 1.

19 2020 The Home Protection for Seniors Severely Disabled Families and Victims of Wildfire or Natural Disaster Act. The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. If your home or business was damaged by a natural disaster you may be.

ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL. New Property Owner Information. You should also expect to receive either one or two separate supplemental bills which are in addition to your annual bill.

You must mail your property tax payments to. TEMPLE ST DEPT MA LOS ANGELES CA 90012-2770. TAXES BECOME DELINQUENT AFTER DECEMBER 31st AND BEAR 100 INTEREST PER MONTH OR ANY PART OF.

Property Tax Installment Plans. For a duplicate bill email us at infottclacountygov. The County is committed to the health and well-being of the public.

La County Tax Collector Duplicate Bill bill county duplicate Edit Po box 99 durango co 81302 phone. Board of Supervisors HILDA L. The 2nd installment payment is due February 1 and becomes delinquent and subject to a 10 percent penalty by April 10.

PAYMENTS WILL NO LONGER BE PROCESSED WITHOUT THE 5 FEE. The La Salle County Tax Assessors Office is now accepting payment of your property taxes with an electronic check or a major credit card online. I Want To Get A Copy Of.

Each year business property statements which provide a basis for determining property assessments for fixtures and equipment are mailed by the Assessors Office to most. 500 West Temple Street Room 153. The PIN cannot be provided by telephone e-mail or fax.

888 807-2111 Toll Free 213 974-8368. Ttclacountygov and propertytaxlacountygov. AIN in the body of the email.

LOS ANGELES COUNTY TAX COLLECTOR PO. Please put DUPLICATE TAX BILL in the subject heading of your email and include the Assessor ID No. Livingston Parish Online Tax Inquiry.

Duplicate tax bills for homeowners available at no charge. You may print your notice by accessing the La Plata County website Treasurer page. COUNTY OF LOS ANGELES TREASURER AND TAX COLLECTOR Kenneth Hahn Hall of Administration.

Los Angeles CA 90054. The 1st installment of your LA County Annual Secured Property Tax Bill is due on November 1 and becomes delinquent if payment is not received by December 10. Annual Secured Property Tax Bills - The Annual Secured Property Tax Bill is mailed on or before November 1 of each year.

At that time delinquent 2nd installment tax amounts will include a statutory 10 percent penalty and a 1000 cost. Senior Citizen Property Tax Assistance. Request for a Duplicate Instruction PermitDriver License.

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. It becomes delinquent and will be subject to a 10 percent penalty if payment is not received or postmarked by the United States Postal Service USPS on or before December. We are accepting in-person online and mail-in property tax payments at this time.

If you wish to make payment prior to the date when the online payment option is available you may mail the payment to.

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Copy Of A Property Tax Bill For La County Property Tax Tax Los Angeles Real Estate

Secured Property Tax Bill Request Treasurer And Tax Collector

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Payment Activity Notice Los Angeles County Property Tax Portal

Real Property Tax Howard County

Important Tax Info Town Of Burlington Wi

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal